Top 30 Rational Formula Stocks 6/6/25 Highlighting BK Technologies BKTI

Each week, I share the top-ranked companies from my Rational Formula ranking system. It’s inspired by the logic behind Greenblatt’s Magic Formula, but built with far greater depth, evaluating companies across 96 factors. The system looks for accelerating fundamentals, efficient capital allocation, expanding margins, and reasonable valuations, with a focus on consistency and improvement across multiple time frames. The goal is to surface high-probability opportunities before they attract broader attention. I also highlight one company each week, sometimes as a deep dive, sometimes just an introduction. That write-up appears below the rankings.

This Week’s Alphabetized List of Companies

(All figures in millions — CAD for Canadian listings, USD for U.S. listings)

1. Acorn Energy, Inc. — ACFN:USA — $44.2M USD

Provides remote monitoring and control systems for industrial assets through its OmniMetrix subsidiary.

2. Altigen Communications, Inc. — ATGN:USA — $15.9M USD

Offers cloud-based communication tools, Microsoft Teams integrations, and AI contact center services.

3. Andrew Peller Ltd. — ADW.A:CAN — $195.8M CAD

Canada’s largest publicly traded wine company, producing wines, craft spirits, and seltzers.

4. Astec Industries, Inc. — ASTE:USA — $905.2M USD

Makes infrastructure equipment for road construction, aggregates, and concrete production.

5. BK Technologies Corp. — BKTI:USA — $156.8M USD

Produces wireless communication systems for public safety, emergency response, and government use.

6. Burnham Holdings, Inc. — BURCA:USA — $110.7M USD

Manufactures boilers and heating products for residential, commercial, and industrial markets.

7. Butler National Corp. — BUKS:USA — $110.2M USD

Specializes in aircraft modifications, avionics, and gaming management services.

8. CareRx Corp. — CRRX:CAN — $178.0M CAD

Canada’s leading pharmacy service provider for long-term care and retirement communities.

9. Crawford United Corp. — CRAWA:USA — $172.3M USD

Diversified manufacturer serving aerospace, healthcare, and industrial equipment sectors.

10. D-Box Technologies, Inc. — DBO:CAN — $60.7M CAD

Develops motion systems that simulate vibration and movement for entertainment and training.

11. D2L, Inc. — DTOL:CAN — $732.0M CAD

Provides learning management systems and cloud-based education software for institutions and corporations.

12. DAVIDsTEA, Inc. — DTEAF:USA — $20.5M USD

Canadian tea company offering a wide range of loose-leaf teas and accessories, mainly online.

13. Espey Manufacturing & Electronics Corp. — ESP:USA — $99.3M USD

Designs and manufactures rugged electronic components for military and industrial clients.

14. Firan Technology Group Corp. — FTG:CAN — $270.9M CAD

Makes high-reliability circuit boards and cockpit display systems for aerospace and defense.

15. Geodrill Ltd. — GEO:CAN — $163.3M CAD

Provides exploration drilling services to gold and base metal mining companies in West Africa.

16. Greystone Logistics, Inc. — GLGI:USA — $36.9M USD

Makes recycled plastic pallets used in supply chain and logistics operations.

17. The Gorman-Rupp Co. — GRC:USA — $970.0M USD

Manufactures pumps and pump systems for municipal, industrial, and commercial use.

18. Imaflex, Inc. — IFX:CAN — $70.5M CAD

Produces polyethylene films for agricultural and industrial packaging applications.

19. Innovative Solutions & Support, Inc. — ISSC:USA — $205.2M USD

Develops avionics and cockpit display systems for commercial and military aircraft.

20. Kaltura, Inc. — KLTR:USA — $340.9M USD

Provides cloud-based video software for enterprises, education, and media companies.

21. Magellan Aerospace Corp. — MAL:CAN — $960.0M CAD

Designs and manufactures aerospace components and systems for commercial and defense markets.

22. Nature's Sunshine Products, Inc. — NATR:USA — $269.0M USD

Makes nutritional supplements, herbs, and personal care products sold through direct channels.

23. NetSol Technologies, Inc. — NTWK:USA — $34.3M USD

Delivers enterprise software for the global leasing and asset finance industry.

24. Nephros, Inc. — NEPH:USA — $36.0M USD

Develops high-performance water filtration systems for medical and commercial use.

25. NowVertical Group, Inc. — NOW:CAN — $52.8M CAD

Provides data analytics and vertical-specific AI solutions to enterprise and government clients.

26. Optex Systems Holdings, Inc. — OPXS:USA — $63.5M USD

Supplies optical sighting systems for military vehicles, weapons systems, and commercial use.

27. Optical Cable Corp. — OCC:USA — $22.3M USD

Designs and manufactures fiber optic and copper cabling systems for communication networks.

28. Paul Mueller Co. — MUEL:USA — $304.5M USD

Makes stainless steel processing equipment for dairy, brewing, pharma, and industrial clients.

29. RF Industries Ltd. — RFIL:USA — $43.8M USD

Produces cable assemblies and interconnect solutions for wireless and wired communication systems.

30. Zoomd Technologies Ltd. — ZOMD:CAN — $114.5M CAD

Offers a unified digital advertising platform that integrates campaign management across channels.

This Week’s Highlighted Company: BK Technologies (BKTI)

BKTI makes rugged land mobile radios for first responders, firefighters, and the U.S. Army. They’ve been around for decades serving a niche market, Wildland Fire. But that’s changing. After years of R&D, they’re now shipping into the broader $2.3B public safety market with new products that solve real problems at a price point competitors can’t match.

From Dominating a Niche to Expanding the Addressable Market

BK’s legacy is in Wildland Fire. Radios designed to work off alkaline batteries in remote zones, built to clone frequencies on the fly, and tough enough to survive in harsh environments. Those features locked in repeat business for decades.

But Wildland Fire is only a slice of the Land Mobile Radio market. So the company made a deliberate push outward. It launched two products:

The BKR 5000, an upgrade on their legacy line but usable in broader public safety contexts

The BKR 9000, a full multiband radio designed to work across jurisdictions and systems

The BKR 9000 is the important one. Most agencies still use single-band radios that don’t talk to each other. The 9000 fixes that, at a $2,500 price point, roughly what many agencies already pay for single-band radios from Motorola that can’t cross jurisdictions.

Built-In Demand: The Replacement Cycle

BK doesn’t disclose the exact number of radios in the field in their latest filings, but in a 2024 interview with Planet Microcap CEO John Suzuki estimated they had around 250,000 active units, with a typical replacement cycle of 10 years.

“If we’ve got about 250,000 radios in the field and they last about 10 years, just on replacement, you’re talking about 25,000 radios a year.” — CEO John Suzuki (2024 interview)

That’s a built-in demand base, before you factor in growth or new accounts.

Q1 2025 Numbers

Revenue came in at $18.1M, up 15% year over year. On the surface, that’s modest. This is a margin recovery story and fixed cost leverage as the mix shifts toward higher-margin products.

Gross margin hit 31.3%, up from 24.6% last year and 28.5% sequentially. That’s a key tell. Management has guided to 50% gross margins longer-term, and they're already on the path. The driver is the BKR 9000. It sells for around $2,500, and according to the CEO, it doesn’t cost much more to build than the 5000. That means every unit sold expands margin.

$22.3M in new orders and a $24.3M backlog as of March 31. That’s more than a full quarter’s revenue already spoken for. If that pace holds, they’re tracking toward or even ahead of their $100M full-year revenue target.

No debt, $4.4M in cash. BK is operating from a clean balance sheet. No interest drag, no refinancing risk. That gives them full operating flexibility to scale production or invest in growth without dilution.

SG&A is tightly controlled. At under $5M for the quarter, it’s about 27% of revenue, already efficient for a hardware company, and likely to scale down as a percentage if revenue steps up.

Trailing twelve-month revenue is $72.3M, and the business just turned solidly profitable.

“The BKR 9000 is priced at about $2,500, but it only costs marginally more than the 5000 to produce. So the more 9000s we ship, the higher our overall gross margins.” — John Suzuki

Competitive Positioning

Motorola dominates the U.S. market, especially in large metro areas. Their multiband radios go for $5,000–$8,000. BK isn’t trying to win there.

They’re targeting the hundreds of smaller counties and agencies that want multiband radios but can’t afford Motorola’s pricing. These are groups who already buy from BK for Wildland Fire use. Now they’re being offered a better radio with more capability, at the same price they’re used to.

They’re targeting where Motorola doesn’t.

Software Optionality

The company also launched a software platform, InteropONE, aimed at push-to-talk voice over LTE. It's still early and not contributing to revenue, but management believes it could become meaningful over time.

“This won’t make a dent in 2025 revenue, but between 2025 and 2030 it could radically change the company.” — John Suzuki

Risks

Replacement demand may not sustain current volume if some of it was catch-up from prior delays or early 9000 adoption.

Small agencies may stick with Motorola out of brand comfort, even at double the cost.

Margin expansion depends on 9000 volume. If adoption slows, the 50% gross margin target may slip.

5000 demand could soften as buyers shift focus to the newer model.

InteropONE could pull focus from core execution, even if it doesn’t consume a lot of capital. They are a small company with about 100 employees.

Customer concentration remains a factor, especially on the Wildland Fire side.

Summary

BKTI has zero debt, a growing backlog, rising margins, and a product that does more at half the price of the incumbent. There’s a large replacement base and a clear price-to-value advantage. The optionality on software is a free throw-in.

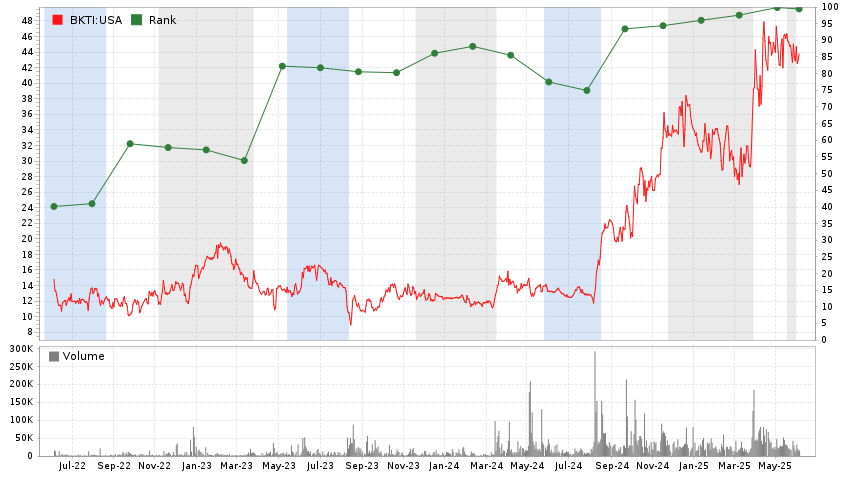

Here’s the 3 year rank chart:

Disclaimer: This post is for informational and educational purposes only. It is not investment advice, nor a recommendation to buy or sell any security. I may or may not own shares in some of the companies in the weekly list. All opinions expressed are solely those of the author and are subject to change without notice. Do your own research and consult a financial advisor before making any investment decisions.

Disclosure: I/we own shares of BK Technologies (BKTI) at the time of this writing.